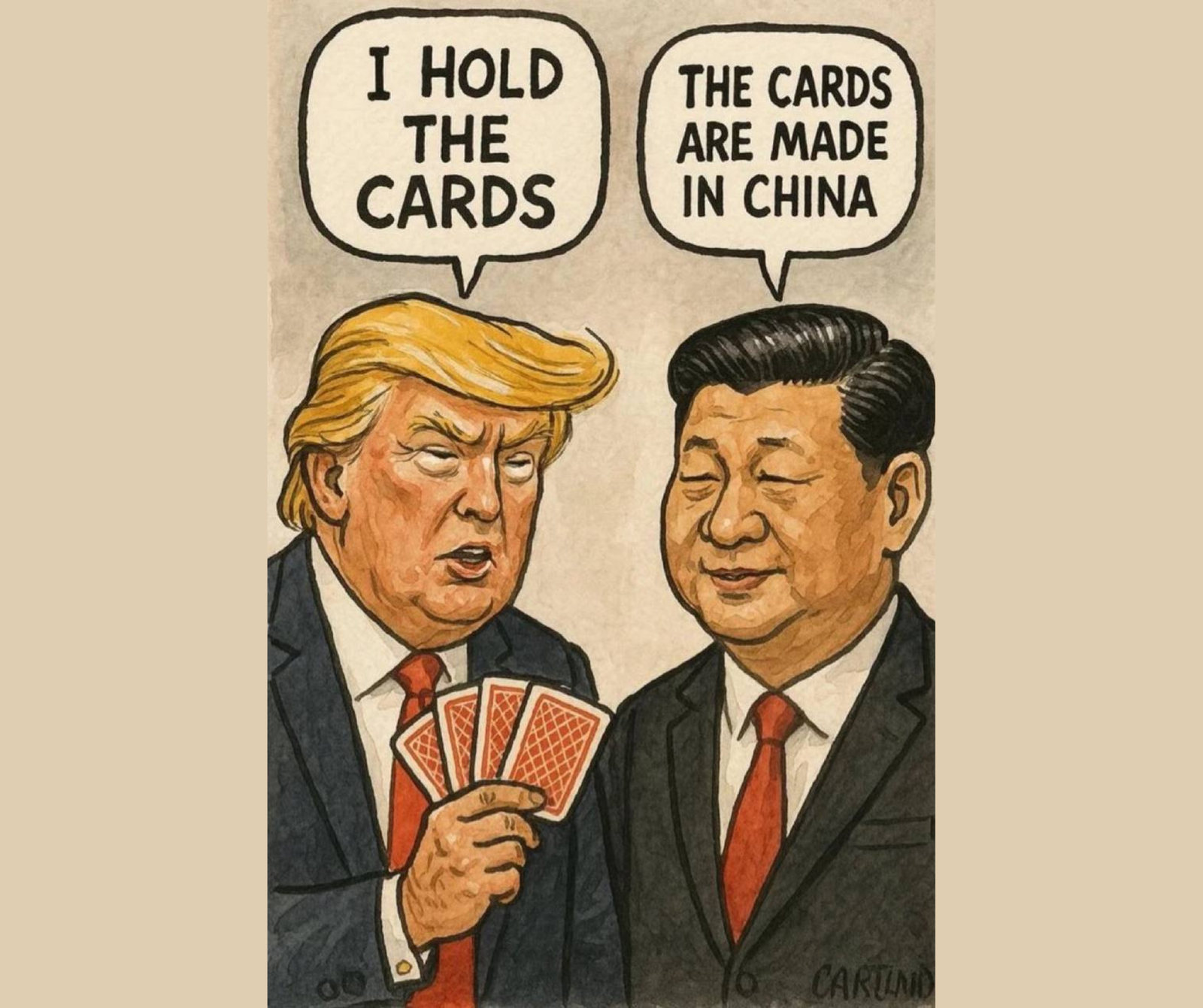

A 5,000 year old civilisation vs a 300 year old idea.

U.S. tariffs on China have triggered a systemic shock, undermining America’s own industry while accelerating a multipolar realignment across Asia, Europe, and the Gulf.

From rare‑earth controls to shipping embargoes, global partners are diversifying away. At home, decades of deindustrialization and a finance‑first economy leave the U.S. poorly positioned to rebound.

A Slur, Not a Strategy:

In early 2025, Vice President J.D. Vance labeled the Chinese “peasants” as he backed 145% tariffs on their exports.

Beijing responded with 125% duties on U.S. goods and demanded that Washington show respect before any talks resume (Bloomberg, 2025).

U.S. officials argue higher tariffs protect critical sectors and curb intellectual‑property theft.

Economists counter that trade deficits stem from domestic under‑saving, not forced “cheating” (Jeffrey Sachs, economist and professor at Columbia University).

Tariffs – Quick Fix or False Promise:

While the intended benefits of these Tariffs are to restore U.S. manufacturing and reduce its deficits. But what we see at the moment is the opposite, higher consumer prices, supply‑chain disruptions, and global growth downgrades (WTO: 2025 GDP +2.2% vs. prior +2.8%).

Experts say, in order to enjoy the intended benefits of these Tariffs, there should be a targeted relief, narrow duties on specific goods—rather than blanket levies.

Retaliation in Action:

Rare‑Earth Controls: China processes over 90% of global supplies. Restrictions on dysprosium, neodymium, terbium threaten U.S. defense and tech production within 48 hours (Reuters, April 2025).

Postal Embargo: Hong Kong suspended most U.S. parcel services in protest of 120% duties (HK Post, April 2025).

Boeing Deliveries Halted: Chinese carriers paused Boeing jet and parts acceptance, striking at U.S. aviation exports (Bloomberg, May 2025).

China being a 5,000 year old civilisation must know a thing or two about survival, I am sure. Beijing must weigh retaliation costs against its own export needs; most Chinese exports still flow to Western consumers.

Since 1971’s end of the gold standard, over $37 trillion of U.S. debt has accumulated; interest now rivals defense spending. Offshored factories and expanded financial services have hollowed out middle‑class opportunities.

In order to trade-war, and win it, against China and the other nations, the US must introduce public‑private incentives to reshore semiconductors and pharmaceuticals, Anti‑trust enforcement to curb excessive financial‑sector concentration, and Infrastructure investment to rebuild manufacturing logistics.

Dual Fronts of Collapse:

External Shock: In International Relations, the Allies are allies till their benefits are allied. Minus the benefits and the allies pivot, as they already have. The trade volumes also go down by 0.2%, global GDP growth cut to 2.2%, and the North American exports set to drop by 12.6% (WTO, 2025).

The EU faces a €1.1 trillion loss by 2028; Germany’s GDP may shrink 1.6% annually (German Economic Institute, 2025).

Internal Strain: Non‑citizen, tourists and people from all walks of life, arrivals to the U.S. fell by 10% in March 2025, risking a $90 billion hit to the tourism industry. (ITA, 2025; Goldman Sachs).

Tariffs exacerbate external isolation while deepening internal fragility.

The Multipolar Counter‑Order:

BRICS nations, Russia, China, and Iran, codified a strategic partnership treaty in January 2025, covering sanctions‑busting, joint military‑technical support, and a roadmap for a revived nuclear accord.

Other Regional Alliances:

- Xi’s Cambodia visit to fund a 180 km canal amid 49% U.S. tariffs on garments will help pivot Cambodia towards China.

- Qatar’s Emir’s visit to Moscow, hints at a possible mediatory role by the nation between the East and the West, but also reinforcing energy‑infrastructure deals.

- Indonesia gave access of its Special Economic Zones to Russian investors.

- China’s trade delegations to EU capitals hints at a possible trade deals between China and the EU, which will be a big relief to the EU in the face of the Tariffs from the US.

- The United Kingdom is maintaining a distinct and independent approach to discussions involving the U.S. and China. The U.K. seeks to address its relations with the U.S. and China separately, recognizing the different dynamics and concerns with each country.

Financial & Tech Fronts for the US:

The Gold price hit $3,306/oz, as central banks are turning to gold as a safe haven to protect themselves from unpredictable changes in the Dollar’s value.

Section 232 Probes: These investigations can lead to the imposition of tariffs on foreign goods to protect domestic industries.

The industries at risk are pharmaceuticals (drugs) and semiconductors (chips).

The U.S. may apply tariffs to imported drugs and chips, which could include products from countries like China, South Korea, or others. The potential duties (tariffs) on these imports could range from 10% to 25%. This means if the investigation results in tariffs, the cost of importing these goods could increase significantly.

The imposition of tariffs on drugs could lead to shortages of essential medications.

Similarly, tariffs on semiconductors, which are critical components for electronics and various technologies, could create supply gaps, affecting industries like consumer electronics, automotive, and manufacturing.

AI Restrictions:

Amid all this chaos, the White House is also considering a ban on Chinese AI lab export DeepSeek, while at the same time urging Nvidia to cease China sales. (NYT, 2025).

Bridge or Abyss:

With the Xi–Putin Victory Day summit on May 9, 2025 approaching, the question looms: Can Washington pivot from combative tariffs to collaborative industrial policy and measured diplomacy? Or will continued coercion cement America’s decline—allowing new multipolar powers to write the next chapter?

A balanced strategy, targeted trade measures, domestic revitalization, and genuine multilateral engagement, is essential to avert a self‑inflicted systemic collapse.

Post a comment

You must be logged in to post a comment.